A Biased View of Custom Private Equity Asset Managers

The Facts About Custom Private Equity Asset Managers Uncovered

You have actually most likely become aware of the term personal equity (PE): spending in firms that are not publicly traded. Roughly $11. 7 trillion in possessions were handled by exclusive markets in 2022. PE firms seek possibilities to earn returns that are far better than what can be accomplished in public equity markets. There might be a couple of points you don't comprehend regarding the sector.

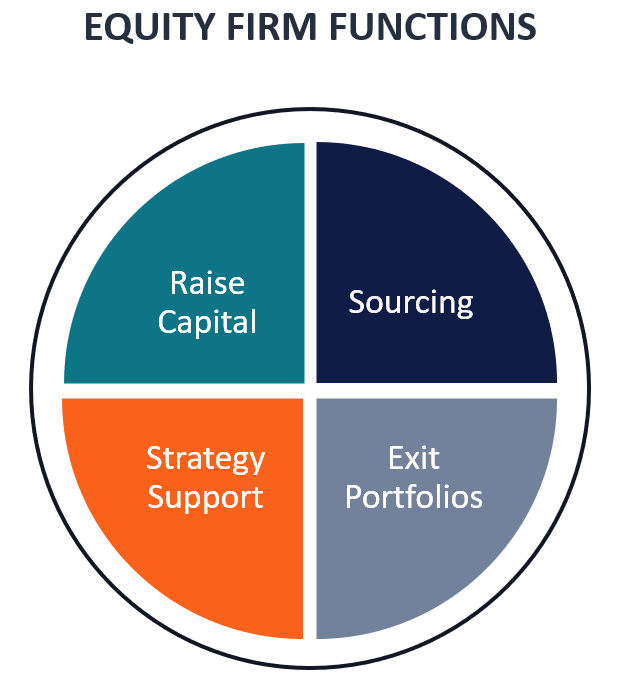

Companions at PE firms increase funds and take care of the cash to produce favorable returns for shareholders, usually with an financial investment perspective of in between four and 7 years. Personal equity companies have an array of financial investment choices. Some are stringent sponsors or easy capitalists entirely dependent on management to expand the firm and create returns.

Since the very best gravitate towards the larger offers, the middle market is a substantially underserved market. There are more sellers than there are extremely skilled and well-positioned money specialists with substantial purchaser networks and resources to manage an offer. The returns of private equity are normally seen after a couple of years.

Fascination About Custom Private Equity Asset Managers

Traveling listed below the radar of large international firms, most of these tiny business frequently supply higher-quality consumer solution and/or particular niche product or services visit this site right here that are not being offered by the large corporations (https://www.nairaland.com/6490712/signal-fastest-growing-app-world/58#127322862). Such advantages draw in the interest of private equity companies, as they have the understandings and wise to make use of such possibilities and take the business to the following level

Personal equity financiers need to have reliable, qualified, and dependable management in area. Many supervisors at profile companies are offered equity and reward settlement structures that compensate them for hitting their financial targets. Such alignment of goals is generally called for before a deal gets done. Exclusive equity chances are often out of reach for individuals that can't invest countless bucks, but they should not be.

There are policies, such as limits on the accumulation quantity of money and on the variety of non-accredited financiers. The personal equity service attracts some of the most effective and brightest in corporate America, consisting of leading performers from Lot of money 500 companies and elite administration consulting companies. Law firms can also be hiring premises for exclusive equity hires, as audit and legal abilities are essential to total offers, and deals are very sought after. https://www.awwwards.com/cpequityamtx/.

See This Report about Custom Private Equity Asset Managers

One more drawback is the absence of liquidity; once in a personal equity purchase, it is not easy to obtain out of or market. With funds under monitoring already in the trillions, personal equity companies have become appealing investment lorries for rich people and organizations.

For years, the attributes of personal equity have made the possession course an appealing proposition for those who could get involved. Since accessibility to personal equity is opening as much as more specific capitalists, the untapped capacity is coming true. The question to think about is: why should you invest? We'll begin with the primary arguments for purchasing personal equity: Just how and why personal equity returns have actually traditionally been higher than other possessions on a variety of levels, Exactly how including private equity in a portfolio affects the risk-return profile, by helping to expand against market and intermittent risk, Then, we will lay out some key factors to consider and threats for personal equity capitalists.

When it involves presenting a brand-new property right into a portfolio, the many fundamental consideration is the risk-return account of that asset. Historically, exclusive equity has exhibited returns comparable to that of Emerging Market Equities and greater than all various other conventional asset classes. Its relatively reduced volatility paired with its high returns produces a compelling risk-return account.

See This Report on Custom Private Equity Asset Managers

As a matter of fact, private equity fund quartiles have the widest series of returns throughout all alternative possession courses - as you can see listed below. Methodology: Internal price of return (IRR) spreads calculated for funds within vintage years individually and after that averaged out. Median IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The takeaway is that fund selection is essential. At Moonfare, we bring out a rigid choice and due diligence procedure for all funds provided on the system. The result of including personal equity right into a portfolio is - as always - based on the profile itself. However, a Pantheon study from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can open 3.

On the various other hand, the very best private equity companies have accessibility to an also bigger pool of unknown possibilities that do not deal with the very same examination, along with the sources to perform due diligence on them and determine which deserve buying (Private Investment Opportunities). Spending at the very beginning means higher risk, but also for the business that do be successful, the fund benefits from greater returns

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Both public and personal equity fund supervisors devote to investing a portion of the fund yet there continues to be a well-trodden concern with aligning rate of interests for public equity fund administration: the 'principal-agent trouble'. When an investor (the 'primary') employs a public fund supervisor to take control of their funding (as an 'agent') they hand over control to the supervisor while preserving ownership of the possessions.

In the instance of exclusive equity, the General Partner doesn't simply gain a monitoring charge. Personal equity funds likewise alleviate one more form of principal-agent problem.

A public equity investor inevitably wants one thing - for the monitoring to raise the supply cost and/or pay out dividends. The capitalist has little to no control over the decision. We showed above the amount of exclusive equity approaches - specifically bulk acquistions - take control of the operating of the firm, making certain that the lasting worth of the company comes first, rising the return on investment over the life of the fund.